June 2024

Annual Report 2023/24

623 Fort Street

Victoria, B.C.

V8W 1G1

The Honourable Raj Chouhan

Speaker of the Legislative Assembly

Province of British Columbia

Parliament Buildings

Victoria, British Columbia

V8V 1X4

Dear Mr. Speaker:

I have the pleasure of submitting the Office of the Auditor General’s Annual Report 2023/24, as required under section 22 of the Auditor General Act.

Michael A. Pickup, FCPA, FCA

Auditor General of British Columbia

Victoria, B.C.

June 2024

Accountability statement

This report reflects the performance of the Office of the Auditor General of British Columbia for the 12 months ending March 31, 2024. It was prepared in accordance with the Auditor General Act and the B.C. Reporting Principles. Fiscal assumptions and policy decisions up to June 1, 2024, have been considered in the report’s development.

I am accountable for the results and selection of performance indicators and for ensuring that the information is measured accurately and in a timely manner. Performance data in this report are reliable and verifiable, and any significant limitations in the quality of the data have been identified and explained.

We include estimates and interpretive statements reflecting management’s best judgment. The measures are consistent with our mission, goals, and objectives, and we focus on aspects essential to the understanding of our performance.

Michael A. Pickup, FCPA, FCA

Auditor General of British Columbia

A message from the auditor general

The Office of the Auditor General’s Annual Report 2023/24 highlights achievements and summarizes the independent assurance and trusted information we provided to the Legislative Assembly.

This is a report on our work toward the goals, objectives, and performance measures set out in our annual service plan. The annual financial statements were prepared in accordance with generally accepted accounting principles. Our financial statements are audited by an independent auditor who also conducts a reasonable assurance review of our annual report.

We worked together to achieve considerable success in the last fiscal year. Our workspace changed dramatically, with the completion of office renovations led by the province’s Leading Workplace Strategies program. We consolidated our space requirements and completely updated it to support flexible, hybrid work styles.

We have also largely completed a new compensation framework for our staff. The new policy is built on fairness, equity, and transparency. It will also help us to attract and retain outstanding team members.

For both of these projects, my office is grateful for the support of the Finance and Government Services Committee.

Other highlights this year included:

- our very positive results from the BC Stats’ Work Environment Survey;

- staff collaboration on the successful development of our new three-year Equity, Diversity, and Inclusion Strategy; and

- our introduction of a new approach to following-up and reporting to the Legislative Assembly on past performance audit recommendations.

Taken together, I’m extremely proud of what our team achieved and I’m honoured to present the results of our efforts.

Sincerely,

Michael A. Pickup, FCPA, FCA

Auditor General of British Columbia

Victoria, B.C.

June 2024

Independent Practitioner’s Reasonable Assurance Report

To the Auditor General of British Columbia

We have undertaken a reasonable assurance engagement with respect to the preparation of the accompanying Annual Report (the “Annual Report”) of the Office of the Auditor General of British Columbia (the “Office”) for the year ended March 31, 2024 in accordance with the Performance Reporting Principles For the British Columbia Public Sector (“BC Reporting Principles”). Our observations in relation to this engagement are presented in the attached Appendix.

Management’s Responsibility

Management is responsible for the preparation of the Annual Report in accordance with the BC Reporting Principles.

Management is also responsible for such internal control as management determines necessary to enable the preparation of the Annual Report to conform with the BC Reporting Principles.

Our Responsibility

Our responsibility is to express a reasonable assurance opinion on the Annual Report based on the evidence we have obtained. We conducted our reasonable assurance engagement in accordance with Canadian Standard on Assurance Engagements (CSAE) 3001, Direct Engagements. This standard requires that we plan and perform this engagement to obtain reasonable assurance about whether the Annual Report conforms with the BC Reporting Principles in all significant respects.

Reasonable assurance is a high level of assurance, but is not a guarantee that an engagement conducted in accordance with this standard will always detect a significant deviation when it exists. Deviations can arise from fraud or error and are considered significant if, individually or in the aggregate, they could reasonably be expected to influence the decisions of users of our report. The nature, timing and extent of procedures selected depends on our professional judgment, including an assessment of the risks of material misstatement, whether due to fraud or error, and involves obtaining evidence about the preparation of the Annual Report in accordance with the BC Reporting Principles.

Our Independence and Quality Control

We have complied with the relevant rules of professional conduct / code of ethics applicable to the practice of public accounting and related to assurance engagements, issued by various professional accounting bodies, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms.

We apply Canadian Standard on Quality Control 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance Engagements and, accordingly, maintain a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Significant Inherent Limitations

As called for by the BC Reporting Principles, the Annual Report contains a number of representations from management concerning the appropriateness of the goals, objectives, and targets established by the Office, explanations of the adequacy of planned and actual performance, and expectations for the future. Management also represents to the extent and nature of information and key performance measures that they believe are critical and meaningful. Such representations are the opinions of management and inherently cannot be subject to independent verification. Therefore, our examination was limited to ensuring the Annual Report contains those representations called for by the BC Reporting Principles and that they are consistent, where applicable with the audited financial statements.

Opinion

In our opinion, the Annual Report of the Office for the fiscal year ended March 31, 2024 conforms in all significant respects with the BC Reporting Principles.

Chartered Professional Accountants

Vancouver, British Columbia

June 24, 2024

Appendix to Independent Practitioner’s Reasonable Assurance Report of BDO Canada LLP on the 2023/24 Annual Report

Observations by the Independent Practitioner

Principle 1 – Explain the Public Purpose Served

The Annual Report explains the Office’s mission and Public purpose, as outlined in enabling legislation. It reports on the organization’s two core business areas and the services/products provided. The Annual Report includes a discussion of the involvement of private sector auditors and the quality assurance measures in place. The Annual Report details the Office’s clients and stakeholders, including the accountability relationship with the Legislative Assembly. Other factors related to understanding performance are identified, including independence and objectivity.

Principle 2 – Link Goals and Results

The Annual Report identifies the organization’s mission, mandate, goals, objectives, and successfully explains their interrelationships. Performance indicators are reported and reflect the core substance of the objectives and focus on short-term and long-term outcomes. The Annual Report explains the variances between planned and actual results, variances from prior years’ results and discusses plans to achieve targeted results in the future. The Annual Report includes a revised set of measures for future years.

Principle 3 – Focus on the Few, Critical Aspects of Performance

The Annual Report provides information to readers by focusing on key performance indicators that management feels are critical to the understanding of the operational performance of the Office. The results of performance, both financial and nonfinancial, are clearly presented. The Annual Report manages its level of detail by referring appropriately to companion documents.

Principle 4 – Relate Results to Risk and Capacity

The Annual Report examines the key risks to the Office and explains the impact of risk and the resulting critical success factors on performance results. The Annual Report addresses capacity in terms of human resources and information technology infrastructure and how these affect the ability to deliver organizational goals and objectives.

Principle 5 – Link Resources, Strategies and Results

The Annual Report highlights key financial information at an organization-wide level. Explanations are provided for variances from prior year and budgeted amounts. The Annual Report conveys efficiency through its discussions and analyses of performance indicators. Links between resources and outputs are discussed and contribute to the reader’s understanding of the efficiency of operations.

Principle 6 – Provide Comparative Information

Where available the Annual Report provides comparative data in its analyses of the performance indicators.

Principle 7 – Present Credible Information, Fairly Interpreted

The Annual Report covers all key aspects of performance using measures that management feels are relevant. The report clearly identifies the data sources used to assess the performance. The Annual Report is reasonably concise, effectively uses tables and graphs to present information and avoids excessive use of specialized terminology.

Principle 8 – Disclose the Basis for Key Reporting Judgments

The Annual Report identifies the sources of information for performance indicator data. Limitations to data sources, where present, are disclosed. The Annual Report discusses the Office’s confidence in the reliability of the data and reports successes and shortcomings in a fair and balanced manner.

Our mandate

Non-partisan and independent of government, the auditor general reports to the Legislative Assembly of B.C. and provides assurance about government’s overall operations. The auditor general is appointed to an eight-year term, as mandated by the Auditor General Act.

The auditor general’s financial audits, performance audits, and other reports provide accurate, objective, and trusted information that supports confidence and improvements in public sector reporting, programs, and services.

The work of the office includes auditing the government’s summary financial statements, which consolidate more than 160 organizations that make up the government reporting entity (GRE). These are organizations that are controlled by, or accountable to, the provincial government, including ministries, Crown corporations, universities, colleges, school districts, and health authorities. The Auditor General has the authority to audit the financial statements of any entity within the GRE and to conduct an audit of the efficiency, economy, and/or effectiveness of any program or service delivered by any organization within the GRE.

In addition to prioritizing areas of risk and significance when selecting performance audits, the auditor general considers issues and concerns identified by members of the Legislative Assembly (MLAs) and the people of B.C. in planning audit work.

The auditor general communicates the work of the office through public reports issued to the Legislative Assembly. Audit reports are referred to the Select Standing Committee on Public Accounts for review and follow-up.

Our vision, mission, values, and guiding principles

Our vision

Engaged people making a difference for the people in B.C.

Our mission

We provide independent assurance and trusted information to assist the Legislative Assembly in holding government accountable. Our work contributes to improved financial reporting, programs, and services for the benefit of the people in B.C.

Our values and guiding principles

We believe in supporting each other to learn and develop. Therefore, we will:

- Give people a chance to try new things.

- Delegate responsibilities and support one another in achieving success.

- Be compassionate when things don’t go as planned and coach for success.

We believe in supporting everyone to do their best work. Therefore, we will:

- Recognize everyone’s contribution and celebrate each other’s successes.

- Cultivate an energetic and positive work environment.

We believe in working together as a high performing team. Therefore, we will:

- Collaborate to achieve success.

- Respect people’s position, knowledge, and experience.

- Recognize and value each other’s strengths and interests.

We believe in acting with integrity. Therefore, we will:

- Do what we know is right even when it’s difficult.

- Be kind, straightforward, transparent, and honest in our dealings with others.

- Uphold our high ethical standards.

We believe in being visionary. Therefore, we will:

- Question the status quo and embrace continuous improvement.

- Consult broadly to include diverse perspectives.

- Bravely support new and innovative approaches.

We are committed to creating and reinforcing diversity, inclusion, and safety. Therefore, we will:

- Build a safe environment where everyone feels they belong and is encouraged to bring their whole selves to work.

- Manage our biases and challenge our assumptions around differences.

- Address behavior that discriminates, excludes, or makes someone feel unsafe.

- Make space for all voices.

Our goals, objectives, and key performance indicators

Our goals

- Support each other to do our best work within an inclusive and engaged workplace culture.

- Live our values and work through difficult issues while treating people respectfully.

- Deliver audits and trusted information that demonstrate value from the resources that are entrusted to us.

Our objectives and key performance indicators

Objective 1: Improve clarity and consistency of processes and information used for corporate governance, planning, and reporting

Key performance indicator

- Work Environment Survey – executive-level management driver

Objective 2: Foster an engaged workplace where all employees are safe, supported, and respected

Key performance indicator

- Work Environment Survey – engagement score

Objective 3: Implement a sustainable workforce plan to build organizational capacity and limit operational risk

Key performance indicator

- Employee turnover rate

Objective 4: Maintain and demonstrate the quality of our audits

Due to low response rates with our previous key performance indicator (KPI), we are not reporting a “quality” KPI in 2023/24. As communicated in our 2024/25–2026/27 Service Plan, we will identify indicators that are better measures of audit quality that will be introduced in our next service plan.

Objective 5: Deliver our audit commitments on time and on budget

Key performance indicator

- Reporting on the government’s summary financial statements

- Delivery of planned number of audit, assurance, and information reports to the Legislative Assembly

| Goal 1 Support each other to do our best work within an inclusive and engaged workplace culture | Goal 2 Live our values and work through difficult issues while treating people respectfully | Goal 3 Deliver audits and trusted information that demonstrate value from the resources that are entrusted to us | |

|---|---|---|---|

| Objective 1 | Yes | Yes | |

| Objective 2 | Yes | Yes | |

| Objective 3 | Yes | Yes | |

| Objective 4 | Yes | ||

| Objective 5 | Yes |

Our people

Overview

We want to provide each staff member every opportunity to do their best work within a collaborative environment. This year we took significant steps to build this culture and support.

We started the year meeting with members of each portfolio to talk about their work unit’s Work Environment Survey results. These conversations confirmed the things that we are doing well and provided opportunities to discuss how we can make the work environment even better. We also sought input from all staff regarding executive-level management survey results. Leaders received the input from these conversations and responded.

All-staff meetings, portfolio learning days, milestone recognition, and celebration events were prominent activities for our office this year, as we all worked to create space in the hybrid landscape where everyone feels connected. We experimented with different formats and agendas to make these events meaningful, informative, and engaging for all.

Continual learning and development is a cornerstone of our office. The quality of our work depends on a combination of audit experience and ongoing education in professional quality management, accounting, and assurance standards. Both of our audit portfolios offered customized learning days for staff to discuss the specific aspects of their practice and emerging trends.

Six employees received temporary appointments within the organization and seven employees were promoted last fiscal year – signs that our support for staff learning and development is paying off.

Knowledge and expertise gained on the job provide tremendous value to the organization. A key indicator – staff stability – is trending positively. This is measured by the percentage of regular staff in the same position at year-end as they were at the start of the year. Staff stability improved from 55 per cent in 2022/23 to 70 per cent in 2023/24.

In addition, our staff turnover rate decreased for the second consecutive fiscal year. We ended the year with fewer vacancies, temporary positions, and retirements than a year ago. These are additional indicators of workforce stability.

Many staff contributed to three important people-focused projects this year.

The first project, leading workplace strategies, saw a transformation of our physical office environment. This transformation supports the reality of working in the hybrid world. We reduced our office footprint and created workspaces that support individuals and teams. We created more spaces for connection and collaboration, including workstations with ergonomic furniture. The project was completed at the end of the fiscal year, with employees moving into the new space at the beginning of 2024/25.

The second people-focused project was the development of our first, three-year, Equity, Diversity, and Inclusion Strategy. This project provided opportunities for all staff to engage in the development of the strategy and promoted important discussions and action through extensive consultations and collaboration. We will launch the strategy in early 2024/25.

A third important project supporting our people is our new compensation framework and policy, which is in the final stages of approval and will be implemented in early 2024/25. This policy sets out an approach to compensation that is competitive with the market, recognizes an employee’s growth in a position, and is fair, equitable, and transparent.

Staffing summary (as of March 31, 2024)

Staff at start of 2023/24

128 regular and 10 auxiliary staff:

- 55% of regular staff had more than one year of experience in their positions

- 45% of regular staff had less than one year of experience in their positions

Staff at end of 2023/24

133 regular and five auxiliary staff:

- 71% of regular staff had more than one year of experience in their positions

- 29% of regular staff had less than one year of experience in their positions

Staff breakdown at end of 2023/24

| Critical Audit Support Services | 37 |

| Performance Audit and Related Assurance | 40 |

| Financial Audit and Related Services | 51 |

| Executive, Legal Services and Professional Practices | 10 |

| Total | 138 |

Staffing activities, 2023/24

New hires:

- 18 competitions

- 13 permanent hires (five from within the B.C. public service and eight from outside)

- 6 auxiliary hires (two became permanent during the year)

Employee movement:

- Auxiliary to permanent status: nine

- Internal lateral moves: none

- Internal temporary appointments: six

- Temporary appointments outgoing to core government: one

- Temporary appointments incoming from core government: one

- Permanent internal promotions: seven

Departures:

- 14 permanent departures

- 7 moved to positions within the public sector

- 2 auxiliary departures

- 3 retirements

Performance indicators

The Work Environment Survey (WES), by BC Stats, is used across the B.C. public service. It provides key performance data for two objectives related to our people. We have used WES engagement scores as key performance indicators for many years. We also leverage internal human resource statistics to review staffing trends and lean on those numbers for a third people-focused key performance indicator.

Objective 1: Improve clarity and consistency of processes and information used for corporate governance, planning, and reporting

Key performance indicator

- Work Environment Survey – executive-level management driver

| 2021/22 Benchmark | 2022/23 Target | 2022/23 Actual | 2023/24 Target | 2023/24 Actual | 2024/25 Target (projected) | 2025/26 Target (projected) | |

|---|---|---|---|---|---|---|---|

| Executive-level management score | 59 | 63 | 62 | 65 | 67 | 67 | 68 |

We exceeded our 2023/2024 target for executive-level management, with a significant improvement over last year’s score of 62. All of our secondary indicator driver scores also improved.

Over the next year executive will continue to focus on communicating with staff about the things that matter to staff and ensure they receive timely updates about decisions and progress on our priorities.

Secondary indicators

- Work Environment Survey drivers:

- Mission, vision, values

- Organization satisfaction

- Organization commitment

WES results – 2019/20 to 2023/24

The engagement scores this year continue an upward trend, with the following results from the 2024 survey:

- Overall engagement: 75

- Organization commitment: 74

- Organization satisfaction: 75

- Job satisfaction: 75

The executive-level management score is also the highest over the past five-year period, with a score this year of 67. These scores are of particular importance as we work to ensure a positive and engaging work environment.

| 2019/20 | 2021/22 | 2022/23 | 2023/24 | |

|---|---|---|---|---|

| WES driver: | ||||

| Executive-level management driver | 46 | 59 | 62 | 67 |

| Secondary indicators: WES drivers | ||||

| Vision, mission, goals | 56 | 72 | 71 | 77 |

| Organization satisfaction | 57 | 65 | 72 | 75 |

| Organization commitment | 63 | 67 | 72 | 74 |

Note: The 2023/2024 survey responses were collected in April 2024, after the close of the fiscal year. The survey was conducted by BC Stats.

Objective 2: Foster an engaged workplace where all employees are safe, supported and respected

Key performance indicator

- Work Environment Survey – engagement score

| 2021/22 Benchmark | 2022/23 Target | 2022/23 Actual | 2023/24 Target | 2023/24 Actual | 2024/25 Target (projected) | 2025/26 Target (projected) | |

|---|---|---|---|---|---|---|---|

| Engagement score | 66 | 69 | 72 | 71 | 75 | 75 | 75 |

Our 2023/2024 overall engagement score surpassed our target at 75 and is reflective of the continued efforts of our office to focus on staff.

Secondary indicators

- Work Environment Survey drivers:

- Respectful environment

- Organization satisfaction

- Teamwork

- Empowerment

WES results – 2019/20 to 2023/24

| 2019/20 | 2021/22 | 2022/23 | 2023/24 | |

|---|---|---|---|---|

| WES driver: | ||||

| Engagement score | 61 | 66 | 72 | 75 |

| Secondary indicators: WES drivers | ||||

| Respectful environment | 70 | 76 | 77 | 80 |

| Organization satisfaction | 57 | 65 | 72 | 75 |

| Teamwork | 79 | 82 | 81 | 83 |

| Empowerment | 64 | 69 | 68 | 72 |

Note: see more information under KPI table on page 17.

Objective 3: Implement a sustainable workforce plan to build organizational capacity and limit risk

Key performance indicator

- Employee turnover rate

| 2021/22 Benchmark | 2022/23 Target | 2022/23 Actual | 2023/24 Target | 2023/24 Actual | 2024/25 Target (projected) | 2025/26 Target (projected) | |

|---|---|---|---|---|---|---|---|

| Turnover rate | 21% | 16% | 17% | 14% | 13% | 12% | 10% |

Note: For 2023/24, turnover for permanent employees, not including retirements and involuntary exits, was 9%.

Our 2023/24 turnover rate was 13 per cent for permanent staff departures. This was an improvement over our 2022/23 rate of 17 per cent and surpassed our target of 14 per cent. While there could be external economic and labour market factors affecting the reduction in turnover, the Work Environment Survey results suggest many staff are choosing to stay with the organization as reflected in our organization satisfaction, organization commitment, and job satisfaction scores.

Half of the staff who left our office last year took new positions elsewhere in core government. While these exits represent a loss of knowledge and expertise for us, the transfer of expertise and knowledge gained here supports the work of the receiving ministries.

With the transition into our new physical and technology environments and other people-focused initiatives underway, we hope to maintain and further improve our workforce stability.

We’ve been a CPA student training office for over 30 years. Last year we supported four students through CPA Canada’s Common Final Exam. CPA BC also conducted a review of our compliance with the CPA pre-approved audit training program and confirmed our ability to train audit path students. On average, we have 12 students at various stages of the program at any time.

We are also pleased to employ university co-op students in our office, two of whom completed their master of public administration theses with us in 2023/24. Another employee who completed a co-op term at our office in 2022 entered our CPA student/associate program in 2023/24.

Our product

Overview

Our office performs financial audits, performance audits, and issues other related reports, including our new annual follow-up report on performance audit recommendations.

These audits and reports serve the people of British Columbia and their elected representatives by reporting on how well government is managing its responsibilities and resources.

Our audits are conducted in accordance with Canadian auditing and assurance standards.

This year, we issued five performance audit reports, three assurance/information reports, and our new annual follow-up report on performance audit recommendations. We issued our annual independent auditor’s report on the government’s summary financial statements as well as 34 independent auditor’s reports for other financial statement audits and assurance engagements.

The quantity and quality of the products we deliver is a credit to the dedication, hard work, and expertise of everyone in our office: from those who work directly on financial and/or performance audits to the many others who provide valuable support services that keep our office and audits moving smoothly. Through our talented people and diverse and dedicated teams, we develop products that continue to meet our output targets.

Performance indicators

Objectives 4 and 5 concern our audit work: maintaining and demonstrating the quality of our reports; and delivering audits on time and on budget.

Objective 4: Maintain and demonstrate the quality of our audits

In past service plans and annual reports, we have looked to a range of external groups – the Legislative Assembly and Select Standing Committee on Public Accounts, as well as the public and the government entities we audit – to measure the relevance of our work and how well we deliver it.

Unfortunately, as communicated in our most recent service plan, MLA participation in our survey to measure the relevance of our work and how well we deliver it has been limited (26% in 2021/22 and 31% in 2022/23). As a result, we determined that this survey is not the most reliable measure of audit relevance and audit quality, and that in 2024/25, we will explore and identify key performance indicators and secondary indicators that are better measures of audit quality.

In our 2022/23 annual report, we noted our intention to move away from another previous measure of quality (percentage of recommendations self-assessed by auditees as implemented) to a new key performance indicator based on recommendations completed by auditees. However, upon further reflection, we believe that it would be more appropriate to reaffirm our commitment to explore and identify better measures of quality in 2024/25 rather than presenting a new key performance indicator at this time.

We continue to receive positive feedback: in the level of confidence in our work expressed by the Select Standing Committee on Public Accounts, and in responses from auditees.

Public awareness

| 2021/22 Benchmark | 2022/23 Results | 2023/24 Results | |

|---|---|---|---|

| Public perception of our office and our work | Positive: 43% Neutral: 48% | Positive: 43% Neutral: 45% | Positive: 46% Neutral: 44% |

| How we measure Positive: Percentage of respondents identifying as “somewhat familiar” or “very familiar” indicating “positive” or “very positive” opinion. Neutral: Percentage of respondents identifying as “somewhat familiar” or “very familiar” indicating “neutral/no opinion.” Source: Angus Reid, March 2024. | |||

Objective 5: Deliver our audit commitments on time and on budget

Key performance indicator

- Reporting on the government’s summary financial statements

- Delivery of planned number of audit, assurance, and information reports to the Legislative Assembly

Financial audits and related assurance work

Financial statement audits involve an examination of an organization’s financial reporting and accounting and conclude on whether an organization’s financial statements are fairly presented and free of material misstatements (significant errors).

We audit financial statements and provide an independent auditor’s report which provides our conclusion on the accuracy and presentation of the financial statements. This report is attached to the front of the organization’s financial statements to show whether the statements meet generally accepted accounting principles and that they have been scrutinized by an independent auditor.

We also audit other financial information, such as compliance with federal agreements.

Audit of the province’s summary financial statements

Our Financial Audit and Related Services (FARS) team leads the annual audit of the government’s summary financial statements. It’s an important responsibility and a key performance indicator for us.

The audit of the 2022/23 Summary Financial Statements was signed-off on August 22, 2023. A copy of our independent auditor’s report is included in the Consolidated Summary Financial Statements of the Government of the Province of British Columbia for 2022-2023 Fiscal Year.

The audit resulted in qualifications, indicating that parts of government’s financial statements are not accurate. Qualifications identify errors or omissions the auditor considers so significant that, if uncorrected, might mislead someone who is relying on the accuracy of the information contained in the financial statements.

Our Financial Statement Audit Coverage Plan looks ahead to the next three fiscal years and our planned audit work for the 139 organizations and 23 ministries in the government reporting entity. The plan is updated annually and the current plan was approved by the Select Standing Committee on Public Accounts on Nov. 29, 2023.

Assurance/information reports

Fraud Risk and Financial Statements: B.C. Public Sector, Part 2

Public sector organizations need a strong fraud risk management framework to safeguard public dollars against potential losses due to fraud. In B.C., government ministries are expected to follow a common approach to fraud detection, prevention, and response, with oversight by the Office of the Comptroller General.

We sent a questionnaire to 22 ministries in 2022/23 to understand how they perceive and manage the risk of fraud, and we reported our findings in 2023/24.

Summary Financial Statements Audit: Supporting the Role of MLAs

The Province of B.C.’s Summary Financial Statements reported $80 billion of public sector financial activity in the 2022/23 fiscal year. The financial statements are the main part of the Public Accounts, released in August.

Our independent audit found three areas of concern, leading to a qualified audit report for the 16th consecutive year.

This report is to help MLAs as they consider the Summary Financial Statements and the implications of our audit.

The Audit of B.C.’s 2022/23 Summary Financial Statements: Areas of Interest

This report follows-up on our audit of the $80 billion of financial activity reported by more than 150 government organizations.

The topics we’ve identified in the report warrant attention because of their potential influence on the accuracy of government’s financial reporting.

They relate to:

- government’s method for estimating personal and corporate income tax revenues;

- BC Hydro’s accounting and implications for its net earnings; and

- implementation of new accounting standards across government.

Performance audits and related assurance/information work

Performance audits look at organizations or programs in the government reporting entity to see if they are meeting objectives effectively, economically, and efficiently.

Our Performance Audit and Related Assurance (PARA) work covers a range of different sectors and subjects including:

- Transportation

- Health care

- Education

- Environment

- Justice

- Economic development

- Governance

- Information technology

Performance audit reports provide fair and objective information to MLAs on the performance of programs and services. Often these reports include recommendations that have been accepted by government that address deficiencies found through the audit.

In addition to the performance audits we produced this year, to better support MLAs, we implemented a new approach to following-up on recommendations. In 2023/24 we published our first annual follow-up report.

The report, released in July 2023, included 18 independent reviews of the progress made by organizations on recommendations from the related 18 performance audits published between 2019 and 2021.

The second annual follow-up report (released in May 2024) was in progress in 2023/24 and covers 24 performance audits published between 2019 and 2022.

Performance audit reports

B.C.’s COVID-19 Response: Destination Development Grants

In 2020, B.C.’s tourism sector was devastated by COVID-19-related closures and nearly two-thirds of people working in the industry lost their jobs. In response, the Ministry of Tourism, Arts, Culture and Sport quickly designed and launched the $41.4-million Destination Development grant program, supporting 106 tourism-related projects across the province.

We looked at whether the ministry administered the grants according to government transfer payment policy and program guidelines.

Board Oversight of Cybersecurity Risk Management at Vancouver Island University

Each B.C. post-secondary board of governors has a critical role in overseeing cybersecurity risk management. They review strategies to protect IT systems and personal data, and they hold university management accountable for those strategies.

This audit focused on the board of Vancouver Island University and its oversight of cybersecurity risk management at the institution.

Managing Hazardous Spills in B.C.

Thousands of spills are reported every year in B.C. – and the number has been going up. These spills can present potential harm to people and the environment.

Our audit examined whether the Ministry of Environment and Climate Change Strategy, through the Environmental Emergency Program, had effectively managed hazardous spills.

B.C.’s Toxic Drug Crisis: Implementation of Harm Reduction Programs

- Audit of the implementation of overdose prevention and supervised consumption services

- Audit of the initial implementation of prescribed safer supply

Since the province declared a public health emergency in 2016, more than 14,000 people have died due to the toxic drug supply.

The Ministry of Mental Health and Addictions and the Ministry of Health lead B.C.’s response, including two harm reduction programs.

We audited the ministries’ implementation of overdose prevention and supervised consumption services. We also audited their implementation of the first phase of prescribed safer supply.

Assurance/information reports

Annual Follow-up Report: Status of Performance Audit Recommendations (2019–2021)

This year we issued our first annual follow-up report.

We reviewed the progress reported by 18 government organizations in completing work to address over 100 recommendations made by our office in performance audits completed in 2019, 2020, and 2021.

Our follow-up report compiled the results of all 18 of those reviews and provided summaries of the information to assist MLAs in their scrutiny of the progress being made by government in completing these recommendations.

Performance audits in progress

Our Work in Progress webpage outlines performance audits that are underway and summarizes the purpose and scope of each audit.

Audit, assurance, and information reports delivered to the Legislative Assembly

| 2021/22 Benchmark | 2022/23 Target | 2022/23 Actual | 2023/24 Target | 2023/24 Actual | 2024/25 Target (projected) | 2025/26 Target (projected) | |

|---|---|---|---|---|---|---|---|

| Number of audit, assurance, and information reports tabled with the Legislative Assembly | 12 | 8 | 8 | 8-10 | 9 | 9-11 | 9-11 |

We are pleased to have met our target in the number of audit, assurance, and information reports delivered to the Legislative Assembly for the second consecutive year, increasing our output from eight reports in 2022/23 to nine in 2023/24.

Reports by the numbers

Financial Audit and Related Assurance Work

- 1 annual independent auditor’s report for the government’s summary financial statements

- 20 independent auditor’s reports for financial statement audits

- 14 independent auditor’s reports for other assurance engagements

- 3 assurance/information reports related to financial statement audits

Performance Audit and Related Assurance Work

- 5 performance audit reports (two of these audits were published in a single public report)

- 1 annual follow-up report on performance audit recommendations

- 18 independent reviews of government’s progress in completing audit recommendations contained in a public compilation report

Additional publications

- Service Plan 2024/25 – 2026/27

- Annual Report 2022/23

- Financial Statement Audit Coverage Plan

Our strategies

We focused on four corporate strategies in 2023/24 to work towards our objectives.

| Objective | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| 1. Establish an employment market competition plan | Yes | Yes | Yes | ||

| 2. Conduct a comprehensive corporate policy refresh | Yes | Yes | Yes | ||

| 3. Implement critical improvements to how we manage audit resources and products | Yes | Yes | |||

| 4. Redesign our office intranet and digital workflows | Yes | Yes | Yes |

Establish an employment market competition plan

In 2023/24, important actions strengthened our competitiveness as an employer.

Benchmarking analyses identified market-competitive starting salaries for all Management Compensation Classification Framework (MCCF) classified positions. This also led to further evidence-based analyses to inform the development of a new compensation framework policy for all staff.

Collaborating with the FARS, PARA, and Critical Audit Support Services portfolios, Human Resources team developed a plan to attract qualified candidates at numerous recruitment and alumni events scheduled throughout the year at B.C. universities and colleges.

We leveraged the office’s strong social media presence to help attract qualified candidates to our job competitions over the past year. A new document about the benefits and advantages of working for our office was sent to prospective candidates.

Conduct a comprehensive corporate policy refresh

Our leadership group reviewed our current policies and identified priorities for refinement and development. Some policies have been paused while related policies are completed, reconsidered until further evidence has been gathered to inform policy directions or eliminated in favour of a more streamlined approach.

A key focus in 2023/24 was developing a compensation framework policy for all staff that is fair, equitable, transparent, and competitive. The policy is under final review and approvals, and we look forward to implementation in early 2024/25.

The compensation framework policy and implementation are grounded in new evidence-based, data analytic procedures that we will incorporate into other corporate planning and policy activities.

Implement critical improvements to how we manage audit resources and products

We have documented and reviewed our management of audit resources and products. We’ve identified what’s working well, what can improve, and confirmed priorities for addressing immediate needs, while also providing the basis for a longer-term plan.

As a result, we changed some processes and updated documentation. This documentation shows how we assign staff in order to meet experience requirements on projects as required by the Canadian Standards on Quality Management. A new policy related to this “assigning internal designations” was also put in place.

Through this work we are assessing our current information systems. We continue to work with our existing timekeeping and project management system while reconfiguring it to better meet our needs. We are piloting this system to include audit staff scheduling. We created a new project management tool for our financial statement audits. We have established a cross-office leadership group to manage this work to continually improve the allocation of resources to achieve results.

Redesign our office intranet and digital workflows

We compiled requirements for the redesigned intranet and scheduled sessions for staff to provide feedback. The new intranet will use modern technology to improve business process integration, offer flexible features, and provide an accessible, mobile-friendly interface.

In 2023/24, we reviewed the existing intranet workflows and identified ways to improve functionality and flexibility. We started transitioning the workflows that support the intranet and business process automation. Some workflows are already in the new environment, while the rest are currently being reviewed and tested.

As part of this work, business processes and associated requirements are being documented according to new standards that are part of our IT Rationalization and Migration Project (RAMP).

The project will see our in-house data centre move to an offsite-managed service, enhancing business continuity and reducing cybersecurity risks. RAMP will also include reviewing business tools to streamline processes and reduce costs.

We have created an inventory of connected private sites and identified content owners. We are carefully reviewing and archiving content as needed. This effort ensures that only current and relevant content is moved to the new intranet, reducing storage costs, and improving content quality for staff

Our finances

Management’s discussion and analysis

In this section, we discuss and analyze our business operations for the year ending March 31, 2024, as compared to our budget and prior year results. The analysis of our financial performance should be read in conjunction with our audited financial statements and the accompanying notes. Our financial statements have been prepared in accordance with Canadian public sector accounting standards.

Financial and business highlights

The Office of the Auditor General is funded by the Legislative Assembly through a voted appropriation. The vote provides separately for operating expenses and capital purchases. Our 2023/24 budget, based on an estimate of the full cost of operations, was $23.4 million for operating expenses and $3.2 million for capital acquisitions.

In 2023/24, the actual cost of our operations was $22 million, and our capital expenditures were $3.1 million. The unused appropriation ($1.4 million for operating expenses and $100,000 for capital acquisitions) can’t be used in subsequent fiscal years. We used 94 per cent of our operating budget in 2023/24.

2023/24 financial summary and comparison to plan and prior year ($000s)

| Expense type | Budget FY24 | FY24 Actual | Variance from budget | FY 23 Actual | Variance Year over Year |

|---|---|---|---|---|---|

| Salaries and benefits | 16,670 | 16,821 | 151 | 14,439 | 2,382 |

| Professional fees | 2,245 | 1,409 | (836) | 1,552 | (143) |

| Rental and utilities | 1,570 | 1,507 | (63) | 1,632 | (125) |

| IT expenses | 1,081 | 881 | (200) | 866 | 15 |

| Office and other | 911 | 856 | (55) | 428 | 428 |

| Travel | 377 | 233 | (144) | 160 | 73 |

| Vehicle expenses | 16 | 16 | – | 12 | 4 |

| Depreciation expense | 475 | 228 | (247) | 289 | (61) |

| Accretion expense | – | 3 | 3 | 2 | 1 |

| Research grants | 70 | 70 | – | 70 | – |

| Total | 23,415 | 22,024 | (1,391) | 19,450 | 2,574 |

The office remains committed to providing the Legislative Assembly and those we audit with timely, independent, and high-value reports, but is making changes to support the delivery of more audit reports annually and greater coverage of government programs. Despite a six per cent underspend, we were still able to deliver on all our financial statement audit commitments and deliver the promised eight to 10 reports to the Legislative Assembly.

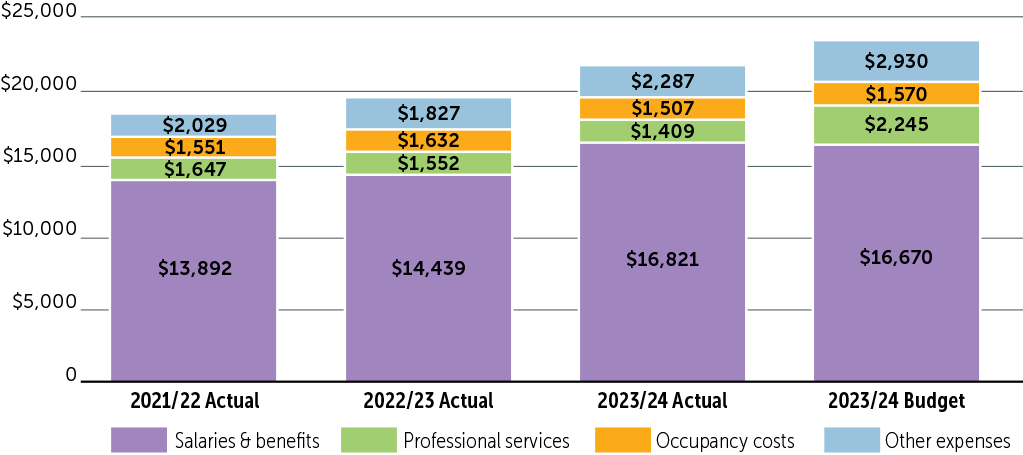

Operating expenses

Salaries and benefits made up 71 per cent of our total operating expenses. This means that changes or fluctuations in staffing can shift our financial performance significantly from what was planned.

Actual spending on salaries and benefits in 2023/24 was $16.8 million. This was $151,000 less than planned but $2.4 million more than we spent in the prior year. Our average staffing throughout the fiscal year was 128 full-time equivalents. Turnover during the year was 13 per cent, four percentage points% lower than in the previous year.

Spending on professional services contracts was $1.4 million – $836,000 below budget due to improved staff retention. Other teams were challenged by the availability of professional services or by a reduced capacity to use those services. Overall, our professional services spending was 37 per cent less than planned.

Our travel spending increased over the prior year, due to relaxed restrictions from the pandemic and public health orders. However, our audit teams were able to continue to accomplish much of their audit work remotely, meaning the increase in travel expenses was less than budgeted.

The table below summarizes the changes in key spending categories over the past three years, as well as the FY24 budget amounts.

Operating expenses, actual versus planned ($000s)

Operating expenses – tabular data

| Operating expenses | 2021/22 Actual | 2022/23 Actual | 2023/24 Actual | 2023/24 Budget |

|---|---|---|---|---|

| Salaries and benefits | 13,892 | 14,439 | 16,821 | 16,670 |

| Professional services | 1,647 | 1,552 | 1,409 | 2,245 |

| Occupancy costs | 1,551 | 1,632 | 1,507 | 1,570 |

| Other expenses | 2,029 | 1,827 | 2,287 | 2,930 |

Capital purchases

In 2023/24, due to the changing work patterns after the pandemic, we made significant investments in our office space efficiency. We also upgraded furnishings and services for a more collaborative and flexible work environment. These changes also reduced our space requirements from three floors to two. We added fully adjustable, shared workstations, smaller meeting rooms, and upgraded IT equipment. Overall, we spent $1,429,873 on tenant improvements, $461,000 on furniture and equipment, and $47,000 on IT upgrades.

This year, we also invested $1.2 million to purchase and configure a modern, supported network within the Province of B.C.’s secure Kamloops data centre. This will house our critical information and replace our aging in-house infrastructure, addressing business continuity risks and minimizing our exposure to evolving security threats.

Looking ahead

Our main resource will always be our staff, and we continue to focus on recruitment and succession planning to ensure continuity through staff departures and retirements. Delays in hiring can have a significant impact on our budget, audits, and corporate support services.

We are committed to our hybrid work environment and refining the balance between working in the office and working remotely. We will continue to complete audits remotely, train virtually, and conduct most meetings using modern collaboration tools.

The IT team will shift its focus from maintaining infrastructure to ensuring the tools and technology effectively support our audit work.

Our fiscal 2024/2025 operating budget is consistent with the current year while our capital budget is significantly reduced ($3.2 million to $263,000) reflecting that our heavy capital investment projects of the past two years are now mostly complete.

Financial statements 2023/24

Statement of management responsibility

The accompanying financial statements of the Office of the Auditor General (the office) are the responsibility of management.

The financial statements have been prepared by management in accordance with Canadian public sector accounting standards. Financial statements are not precise, since they include certain amounts based on estimates and judgments. When alternative accounting methods exist, management has chosen those it considers most appropriate in the circumstances to ensure that the financial statements are presented fairly in all material respects.

We have developed and maintain systems of internal control that give reasonable assurance that the office has:

- operated within its authorized limits,

- safeguarded assets,

- kept complete and accurate financial records.

The Select Standing Committee on Finance and Government Services of the Legislative Assembly appointed BDO Canada LLP, Chartered Professional Accountants, to audit the accounts of the office for the year ended March 31, 2024.

Michael A. Pickup, FCPA, FCA

Auditor General

Marie Thelisma, CPA, CMA

Assistant Auditor General

External auditor’s opinion on the financial statements

Independent Auditor’s Report

To the Auditor General of British Columbia

Opinion

We have audited the accompanying financial statements of the Office of the Auditor General (the “Office”), which comprise the Statement of Financial Position as at March 31, 2024, the Statements of Operations, Changes in Net Debt and Cash Flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Office as at March 31, 2024, and the results of its operations, changes in net debt, and cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for Opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Office in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Other Information

Management is responsible for the other information. The other information comprises the information included in the Annual Report but does not include the financial statements and our auditor’s report thereon.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

Our Independence and Quality Control

We have complied with the relevant rules of professional conduct / code of ethics applicable to the practice of public accounting and related to assurance engagements, issued by various professional accounting bodies, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms.

We apply Canadian Standard on Quality Control 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance Engagements and, accordingly, maintain a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Office’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Office or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Office’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Office’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Office’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Office to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Chartered Professional Accountants

Vancouver, British Columbia

June 24, 2024

Statement of financial position

| As at March 31, 2024 (in $000s) | Note | 2024 | 2023 |

|---|---|---|---|

| Financial assets | |||

| Petty cash | 2 | 2 | |

| Due from the consolidated revenue fund | 3 | 2,106 | 696 |

| Total financial assets | 1,827 | 2,287 | |

| Liabilities | |||

| Accounts payable and accrued liabilities | 2,566 | 1,169 | |

| Asset retirement obligation | 4 | 138 | 72 |

| Total liabilities | 2,704 | 1,241 | |

| Net debt | (596) | (543) | |

| Non-financial assets | |||

| Tangible capital assets | 5 | 3,618 | 664 |

| Prepaid expenses | 6 | 458 | 472 |

| Total non-financial assets | 4,076 | 1,136 | |

| Accumulated surplus | 7 | 3,400 | 593 |

Approved by:

Michael A. Pickup, FCPA, FCA

Auditor General

Marie Thelisma, CPA, CMA

Assistant Auditor General

The accompanying notes are an integral part of these financial statements.

Statement of operations

| For the fiscal year ended March 31, 2024 (in $000s) | Note | 2024 Budget | 2024 Actual | 2023 Actual |

|---|---|---|---|---|

| Expenses | ||||

| Salaries and benefits | 16,670 | 16,821 | 14,439 | |

| Professional fees | 2,245 | 1,409 | 1,552 | |

| Occupancy costs | 1,570 | 1,507 | 1,632 | |

| Information technology | 1,081 | 881 | 866 | |

| Office | 899 | 836 | 428 | |

| Travel | 377 | 233 | 160 | |

| Depreciation | 475 | 228 | 289 | |

| Accretion | – | 3 | 2 | |

| Research grants | 70 | 70 | 70 | |

| Vehicle | 16 | 16 | 12 | |

| Other | 7 | 7 | – | |

| Advertising | 5 | 13 | – | |

| Total cost of operations | 23,415 | 22,024 | 19,159 | |

| Funding appropriations | ||||

| Operating | 8 | 22,940 | 21,793 | 19,159 |

| Capital | 8 | 3,200 | 3,118 | 97 |

| Accumulated surplus (deficit) | 2,725 | 2,887 | (194) | |

| Accumulated surplus beginning of year | 7 | 593 | 593 | 787 |

| Accumulated surplus end of year | 3,318 | 3,480 | 593 | |

The accompanying notes are an integral part of these financial statements.

Statement of changes in net debt

| For the fiscal year ended March 31, 2024 (in $000s) | Note | 2024 Budget | 2024 Actual | 2023 Actual |

|---|---|---|---|---|

| Net debt at beginning of year | (543) | (543) | (507) | |

| Annual surplus (deficit) | 2,725 | 2,887 | (194) | |

| Changes in tangible capital assets | ||||

| Acquisition of tangible capital assets | (3,200) | (3,118) | (97) | |

| Amortization of tangible capital assets | 475 | 231 | 289 | |

| Asset retirement obligation change of estimate | – | (67) | – | |

| (2,725) | (2,954) | 192 | ||

| Changes in working capital assets | ||||

| Acquisition of prepaid expenses | – | (458) | (472) | |

| Use of prepaid expenses | – | 472 | 438 | |

| – | 14 | (34) | ||

| Decrease (increase) in net debt | – | (53) | 192 | |

| Net debt at end of year | (543) | (596) | (543) | |

The accompanying notes are an integral part of these financial statements.

Statement of cash flows

| For the fiscal year ended March 31, 2024 (in $000s) | Note | 2024 | 2023 |

|---|---|---|---|

| Due from Consolidated Revenue Fund, beginning of year | 696 | 508 | |

| Operating transactions | |||

| Cash used to: | |||

| Pay employees or benefits plans | (16,975) | (14,124) | |

| Pay suppliers | (3,408) | (4,847) | |

| (20,383) | (18,971) | ||

| Cash received from: | |||

| Operation appropriation | 21,793 | 19,159 | |

| Capital transactions | |||

| Cash used to: | |||

| Acquire tangible capital assets | 5 | (3,118) | (97) |

| Financing transactions | |||

| Cash received from: | |||

| Capital appropriation | 3,118 | 97 | |

| Increase in due from consolidated revenue fund | 1,410 | 188 | |

| Due from Consolidated Revenue Fund, end of year | 3 | 2,106 | 696 |

The accompanying notes are an integral part of these financial statements.

Notes to our financial statements

Year ended March 31, 2024 (tabular amounts in $000s)

1. Nature of operations

The Auditor General is an Officer of the Legislature of British Columbia appointed under the Auditor General Act (the act). The act, as amended March 13, 2013, allows for the appointment of an auditor general for a single, eight-year term by the Legislative Assembly. Non-partisan, objective and independent of the government of the day, the auditor general reports impartial assessments of government accountability and performance to the assembly.

The auditor general’s mandate is established by the act. The act requires the auditor general to audit the government’s annual Summary Financial Statements and allows the auditor general to be appointed as the financial statement auditor of any government organization or trust fund. The act also allows the auditor general to carry out examinations focusing, among other things, on whether government or a government organization is operating economically, efficiently, and effectively; and whether the accountability information provided to the Legislative Assembly by the government or a government organization with respect to the results of its programs is adequate.

Funding for the Office of the Auditor General comes from a voted appropriation (the vote) of the Legislative Assembly.

2. Significant accounting policies

These financial statements have been prepared in accordance with Canadian public sector accounting standards (PSAS).

a. Voted appropriation

The office receives approval from the Legislative Assembly to spend funds through an appropriation vote. The vote provides for both operating expenses and capital acquisitions. Non-cash transactions, such as amortization, are covered by the vote but not recognized as revenue from the appropriation of funds. An annual excess or deficiency of revenues over expenses arises from the difference between revenue recognition of capital appropriations and expense recognized for the amortization of tangible capital assets.

Any unused vote amounts cannot be carried forward for use in subsequent years.

b. Financial instruments

It is management’s opinion that the office is not exposed to significant interest, currency or credit risk arising from these instruments.

A statement of remeasurement gains and losses has not been prepared as there are no such gains or losses.

c. Asset retirement obligation

Asset retirement obligations are legal obligations associated with the retirement of tangible capital assets. This includes post-retirement operation, maintenance, and monitoring that are an integral part of the retirement.

Liabilities for asset retirement obligations are recorded when there is a legal obligation to incur retirement costs in relation to a tangible capital asset, the past transaction or event giving rise to the liability has occurred, and a reasonable estimate of the amount can be made.

The costs of asset retirement obligations are recognized over the estimated useful lives of the underlying tangible capital assets.

d. Tangible capital assets

Tangible capital assets are recorded at historical cost less accumulated amortization. Amortization begins when the assets are put into use and is recorded using the straight-line method over the estimated useful lives of the assets as follows:

| Computer hardware and software | 3 years |

| System hardware and software | 5 years |

| Furniture and equipment | 5 years |

| Tenant improvements | Term of lease (ends October 2034) |

e. Presentation of expenses

The office provides audit services for the Legislative Assembly. Audit services include both financial statement audits and performance audits. Since audit services are the office’s sole service line, expenses are presented by object in the statement of operations.

f. Employee future benefits

i. Pension benefits

All eligible employees participate in a multi-employer, defined benefit pension plan.

Defined contribution plan accounting has been applied to the plan as the office has

insufficient information to apply defined benefit plan accounting. Accordingly, the

office’s contributions are expensed in the year in which the employees’ services

are rendered and are included as a component of salaries and benefits on the

statement of operations. These contributions represent the office’s total obligation for

pension benefits.

ii. Other future benefits

Eligible employees are entitled to post-employment health care and other benefits as provided under terms of employment agreements. The cost of these benefits is recorded as employees render the services necessary to earn them. The liability for the other future benefits is managed and recorded by the BC Public Service Agency.

iii. Leave liability

Eligible employees are entitled to accumulate earned, unused vacation, and other eligible leave entitlements as provided under terms of employment or collective agreements. The liability for the leave is managed and recorded by the BC Public Service Agency.

g. Measurement uncertainty

These financial statements are prepared in accordance with PSAS, which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Estimates are used to determine asset retirement obligations. The estimated useful lives of tangible capital assets are the most significant item for which estimates are used. Actual results could differ from those estimates. These estimates are reviewed annually, and as adjustments become necessary, they are recognized in the financial statements in the period in which they become known.

3. Due from the Consolidated Revenue Fund

The office does not have its own bank account or hold cash or cash equivalents. All monetary transactions of the office are processed through the Consolidated Revenue Fund (CRF) of the Province of British Columbia. This balance is reflective of differences in the timing of events that obligate the office, and therefore the CRF, to distribute funds, and the receipt of the benefit from disbursing those funds. The statement of cash flows presents the continuity of this balance and all component flows.

4. Asset retirement obligation

The office has installed tenant improvements in the building that it leases and may be required, by the landlord, to remove them when the lease ends. A liability for the estimated cost of removal has been accrued. The estimated cost to remove the tenant improvements when the lease ends in October 2034, using a discount rate of 3.47% is $200,670.

5. Tangible capital assets

| Computer hardware and software | Network hardware and software | Furniture and equipment | Tenant improvements | Total | |

|---|---|---|---|---|---|

| Year ended March 31, 2023 | |||||

| Opening net book value | 325 | 162 | 18 | 351 | 856 |

| Additions | 95 | – | 2 | – | 97 |

| Disposals | – | – | – | – | – |

| Amortization | (174) | (87) | (6) | (22) | (289) |

| Closing net book value | 246 | 75 | 14 | 329 | 664 |

| At March 31, 2024 | |||||

| Cost | 1,361 | 910 | 616 | 511 | 3,398 |

| Accumulated amortization | (1,115) | (835) | (602) | (182) | (2,734) |

| Net book value | 246 | 75 | 14 | 329 | 664 |

| Year ended March 31, 2024 | |||||

| Opening net book value | 246 | 75 | 14 | 329 | 664 |

| Additions | 47 | 1,181 | 461 | 1,493 | 3,182 |

| Disposals | – | – | – | – | – |

| Amortization | (152) | (49) | (5) | (22) | (228) |

| Closing net book value | 141 | 1,207 | 470 | 1,800 | 3,618 |

| At March 31, 2024 | |||||

| Cost | 1,408 | 2,091 | 1,077 | 2,004 | 6,580 |

| Accumulated amortization | (1,267) | (884) | (607) | (204) | (2,962) |

| Net book value | 141 | 1,207 | 470 | 1,800 | 3,618 |

6. Prepaid expenses

| March 31, 2024 | March 31, 2023 | |

|---|---|---|

| Software and hardware maintenance | 313 | 245 |

| Rents | 102 | 129 |

| Other | 43 | 98 |

| 458 | 472 |

7. Accumulated surplus

The accumulated surplus balance represents the portion of the net book value of tangible

capital assets that have been funded through appropriations.

8. Funding appropriations

The office receives approval from the Legislative Assembly to spend funds through an appropriation that includes two components—operating and capital. Any unused appropriations lapse at the fiscal year-end.

The budget for expenses shown on the statement of operations includes depreciation of tangible capital assets and is based on the budgeted expenses approved by the Select Standing Committee on Finance and Government Services.

The following table reconciles the operating appropriation and provides a comparison of current and prior year voted capital and operating appropriations. There are no reconciling items for the capital appropriation.

| Year ended March 31 | 2024 | 2023 |

|---|---|---|

| Voted appropriation, operating | 23,415 | 20,815 |

| Cost of operations | 22,023 | 19,450 |

| Depreciation | (228) | (289) |

| Accretion | (3) | (2) |

| Operating appropriation | 21,793 | 19,159 |

| Unused operating appropriation | 1,622 | 1,656 |

| Voted appropriation, capital | 3,200 | 400 |

| Capital purchases | 3,118 | 97 |

| Unused capital appropriation | 82 | 303 |

9. Employee future benefits

The office and all eligible employees contribute to the Public Service Pension Plan, a multi-employer, defined benefit, and joint trusteeship plan, established for certain British Columbia public service employees. The British Columbia Pension Corporation administers the plan, including payments of pension benefits to eligible employees. A board of trustees, representing plan members and employers, is responsible for overseeing the management of the plan, including investment of assets and administration of benefits.

The plan is contributory, and its basic benefits are based on years of service and average earnings at retirement. Under joint trusteeship, the risks and rewards associated with the plan’s unfunded liability or surplus is shared between the employers and the plan members and will be reflected in their future contributions.

Every three years an actuarial valuation is performed to assess the financial position of the pension plan and the adequacy of the funding. The latest actuarial valuation, performed as of March 31, 2021, reported the fund was 110% funded with assets of $30,452 million and liabilities of $27,785 million.

Expenses related to employee future benefits incurred during the year were $1,300,355 (2023 -$1,045,035).

10. Contractual obligations

The office leases two multifunction devices and two photocopiers under agreements that terminate in February 2028.

The office occupies a single office building under a 20-year lease agreement which terminates Oct. 31, 2034. The total future minimum lease payments for the duration of the lease are estimated to be $19.6 million.

Future minimum payments for each of the next five years under the terms of the commitments, as of March 31, 2023, are estimated as follows:

| Fiscal year | Commitment |

|---|---|

| 2024/25 | 1,653 |

| 2025/26 | 1,765 |

| 2026/27 | 1,765 |

| 2027/28 | 1,764 |

| 2028/29 | 1,758 |

| 8,705 |

11. Related party transactions

a. Business transactions

While our work is independent of government, the office is financially related, because of common control, to all Province of B.C. ministries, agencies, Crown corporations, and all other public sector entities that make up the government reporting entity of the Province of B.C. Transactions with such entities are in the normal course of business, are recorded on an accrual basis, and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

a. Services provided and received without charge

The Province of B.C. has centralized some of its administrative activities for efficiency and cost-effectiveness purpose. The purpose of this shared services model is that one area of government performs the service for other areas without charge.

Services provided:

The office receives external auditing services from the Legislative Assembly. The audit firm is appointed by a committee of the Legislative Assembly. The estimated value of these services is $37,637 in the current year (2023 – $42,768).

Appendix A

Summary of work issued in 2023/24

Independent auditor’s reports for financial statement audits and other assurance engagements

Public Accounts

- Summary Financial Statements, Province of British Columbia

- Summary of Public Debt, Key Indicators of Provincial Debt and Summary of Performance Measures

School districts

- School District No. 63 (Saanich)

Universities, colleges, and institutes

- University of British Columbia

Other post-secondary institution reports

- University of British Columbia Foundation

- University of British Columbia – FTE Enrolment Report

- University of British Columbia – Independent Auditor’s Report on the Consolidated Financial Statements Accompanied by Financial Responsibility Supplemental Schedule

- University of British Columbia – Independent Auditor’s Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards

- University of British Columbia – Independent Auditor’s Report on Compliance for the Direct Loan Program Required by the Guide for Financial Statement Audits and Compliance Attestation Engagements of Foreign Schools